The United States dental laboratory industry presents a significant paradox: a consistent, decades-long decline in the number of individual establishments is occurring simultaneously with robust growth in overall market value. This dynamic is not a sign of a shrinking sector but rather one of profound structural transformation. The market, valued at over $7 billion in 2023, is projected to grow at a compound annual growth rate (CAGR) of approximately 6.3% through 2030, driven by powerful demographic trends and increasing consumer demand for complex restorative and cosmetic procedures.1 However, the landscape of providers is contracting and consolidating. The fragmented industry of the past, characterized by thousands of small, independent labs, is rapidly giving way to a more concentrated market dominated by large-scale, technologically advanced Dental Laboratory Organizations (DLOs). This report provides a comprehensive analysis of the forces driving this evolution, quantifies the state of the industry, and offers a strategic outlook for stakeholders.

Three dominant and interconnected forces are reshaping the U.S. dental laboratory landscape. Understanding these themes is critical to navigating the market's future.

This report will deconstruct these themes in detail. It begins by quantifying the number of dental labs in the U.S., reconciling disparate data sources to reveal the definitive trend of contraction. It then analyzes the industry's economic health, market segmentation, and competitive structure. Subsequent sections provide a deep dive into the primary drivers of change—consolidation, the workforce crisis, and technological disruption. The report concludes with a forward-looking analysis of the industry's future trajectory and strategic imperatives for investors, DSOs, and laboratory owners.

Determining the precise number of dental laboratories in the United States is a complex task, with various data sources presenting a wide range of figures. This discrepancy is not necessarily a contradiction but rather a reflection of different methodologies, definitions, and scopes of coverage. Market research firms like Mordor Intelligence and iStar Dental Lab reported the number of labs to be 9,259 in 2023 12, while InfoGlobalData suggests a figure "over 10,000".14 In contrast, industry analysis firm IBISWorld provides a more conservative estimate of 8,612 labs in 2024.15

Data from government and industry bodies further illustrates this complexity. The National Association of Dental Laboratories (NADL), citing the U.S. Department of Labor (DOL), has offered various figures over the years, including "just under 5,000" operating labs 16, 6,100 labs with multiple employees 17, and a 2012 count of 7,042 labs with a payroll, supplemented by fewer than 3,000 "one-man" sole-proprietor labs.8 Meanwhile, the business data provider SICCODE.com lists 4,416 "verified active companies" operating under the North American Industry Classification System (NAICS) code 339116 for Dental Laboratories.18

The variance in these numbers stems from a critical distinction: whether the count includes only establishments with paid employees (employer firms) or also encompasses non-employer, sole-proprietor businesses. Government data series like the U.S. Census Bureau's County Business Patterns (CBP) traditionally focus on employer establishments, which can lead to an undercount of the total business population.19 The NADL's distinction between multi-employee labs and "one-man" labs highlights this same division.8 Commercial data providers may use different criteria, sometimes including non-employer firms or having broader definitions, resulting in higher estimates.14 The lowest figures, such as those from the NADL or SICCODE.com, likely represent a core of more established, commercially active businesses.

Given this landscape, any single absolute number is a flawed metric without proper context. The most valuable and consistent takeaway from all available data is not a specific count but the universally acknowledged directional trend. The focus of any strategic analysis must therefore shift from "how many labs exist" to "why is the number of labs changing, and what is the structure of those that remain?"

Regardless of the source, the data points to a clear and sustained contraction in the number of U.S. dental laboratories over the last two decades. The NADL, for example, noted a 22% decline in the number of labs with multiple employees, from 7,800 in 2004 to a more recent figure of 6,100.17

Historical data from IBISWorld provides a distinct time-series illustration of this trend. The number of dental labs peaked at 10,523 in 2007 before beginning a steady decline. By 2024, the number had fallen to 8,612, representing a contraction of over 18% from its peak.15 This decline is ongoing and persistent. IBISWorld reports an average annual decline of 0.6% between 2019 and 2024 and projects an accelerated decrease of 0.9% in 2025, which would bring the total number of establishments down to 8,534.15 This long-term trend of contraction is a central feature of the modern dental laboratory market.

The distribution of dental laboratories across the United States is not uniform; it is heavily concentrated in states and metropolitan areas with large populations. Data indicates that the states with the highest number of dental labs are California (763 labs), Florida (448 labs), and New York (340 labs).12

This geographic concentration is strongly corroborated by employment data from the U.S. Bureau of Labor Statistics (BLS), which serves as a reliable proxy for laboratory activity. The May 2023 Occupational Employment and Wage Statistics (OEWS) survey shows that the states with the highest employment of dental technicians are California (4,490 technicians), New York (2,590 technicians), and Florida (2,410 technicians).20 This alignment confirms that laboratory infrastructure is centered in these key states.

The concentration is even more pronounced at the metropolitan level. The Los Angeles-Long Beach-Anaheim, CA, metropolitan area alone employs 2,390 dental technicians, while the New York-Newark-Jersey City, NY-NJ-PA, area employs 1,670. These two regions represent a significant portion of the nation's total dental technician workforce, underscoring the urban-centric nature of the industry.20

.png)

In stark contrast to the declining number of establishments, the U.S. dental laboratories market is economically robust and poised for significant growth. The market size was valued between $7.0 billion and $7.2 billion in 2023 and 2024.1 Market research forecasts project this value to increase at a healthy Compound Annual Growth Rate (CAGR) of approximately 6.3% between 2024 and 2030.1

This growth is propelled by several powerful macroeconomic and social trends. The aging of the U.S. population is a primary driver, as the geriatric demographic has a higher incidence of tooth loss and complex oral health needs, increasing demand for restorative products like dentures, crowns, and bridges.1 Concurrently, there is a rising consumer demand for cosmetic dentistry, with a large percentage of individuals viewing their smile as a crucial social asset, fueling the market for aesthetic restorations like veneers.2 Finally, ongoing technological advancements in materials and digital workflows are enabling more efficient and effective treatments, further expanding the market.1

The U.S. market is a global leader, accounting for over 14.2% of the worldwide dental laboratory market.1 It is the largest component of the North American market, which itself represents over 35% of global revenue, a dominance attributed to the region's high healthcare expenditure, established infrastructure, and high public awareness of oral health.2

The dental laboratory market can be segmented by the types of products fabricated, the materials used, and the equipment required for production.

The competitive landscape is undergoing a dramatic transformation, moving away from fragmentation and toward concentration. The market is increasingly characterized by the dominance of a few very large players. Glidewell Dental and National Dentex Labs (NDX) are consistently identified as the two titans of the industry.14 Glidewell is described as an "industry giant" with a network of 15 labs and over 5,000 employees nationwide. Similarly, NDX operates one of the largest networks, with more than 55 labs and over 5,000 professionals.14

These entities are more than just large laboratories; they are best understood as Dental Laboratory Organizations (DLOs). They operate extensive national networks, achieving significant economies of scale in material purchasing, logistics, marketing, and technology deployment. Their growth and scale are central to understanding the industry's structural shift.

The evidence points toward a market that is bifurcating, leading to a "hollowing out" of the middle. The number of laboratory establishments is in decline, yet the total number of employed dental technicians has remained relatively stable over the last several years.17 At the same time, giants like Glidewell and NDX are growing and employ thousands of technicians each.14 The logical conclusion is that technicians from the multitude of closing labs are not leaving the industry but are being absorbed into these larger, more efficient DLOs.

This process is creating a polarized market structure. At one end are the massive, technology-driven DLOs that are equipped to serve large, price-sensitive DSO clients and compete on the basis of scale, efficiency, and logistics. At the other end is a large number of very small, often one-to-four-person, boutique labs that survive by offering highly specialized skills, artistic craftsmanship, or strong, personal relationships with local dentists. The businesses that are disappearing are the mid-sized establishments—those too small to compete with the DLOs on price and scale, but too large and generalized to be as agile or specialized as the boutique labs. These labs are caught in an unsustainable middle ground and are the primary casualties of the industry's ongoing consolidation.

Note: Figures for 2024-2030 are projections based on a CAGR of 6.32% as reported by Grand View Research.1

.png)

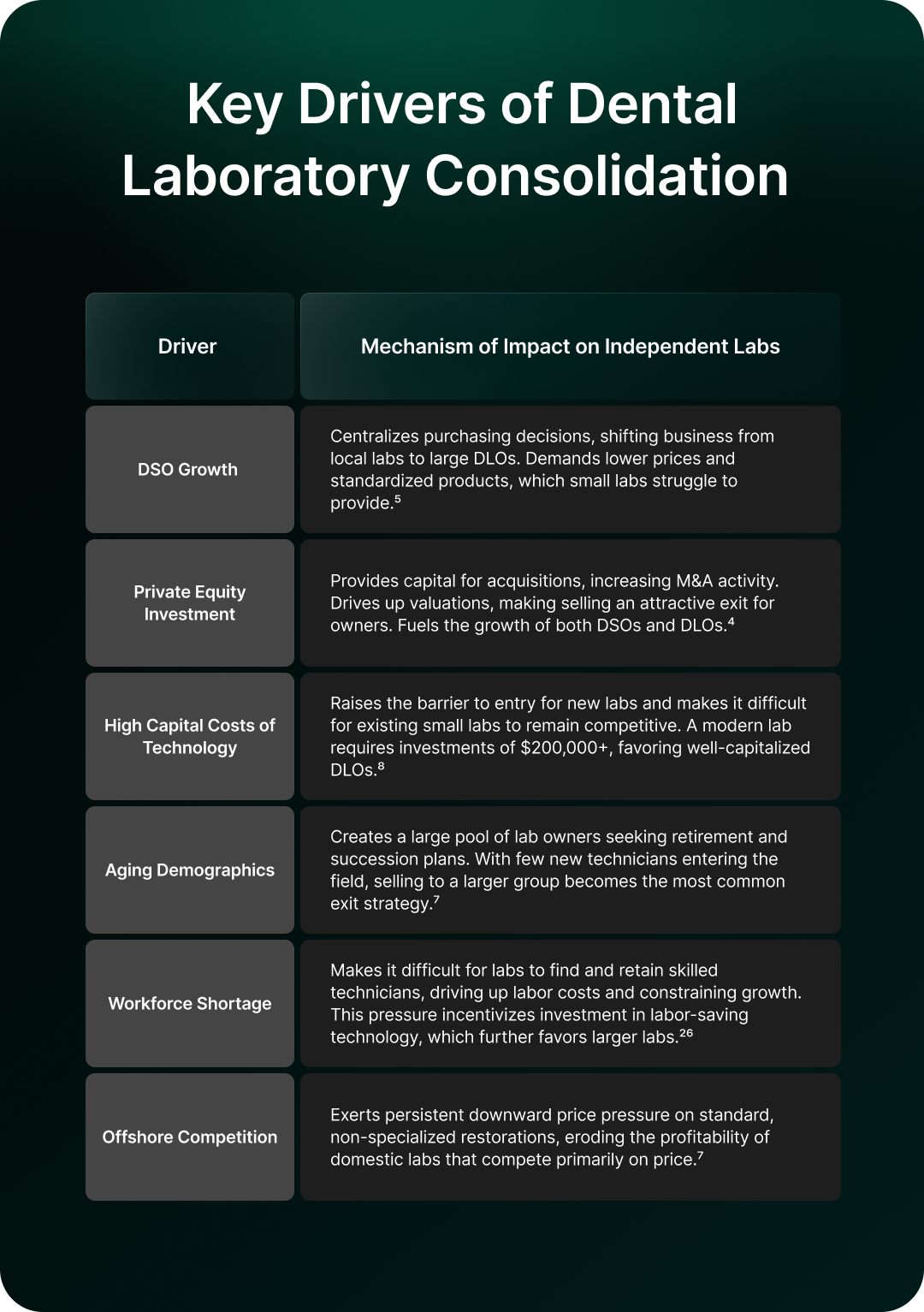

The steady decline in the number of independent dental laboratories is not a random phenomenon but the result of a confluence of powerful market, financial, and demographic forces. These drivers are systematically reshaping the industry's competitive structure, favoring scale and consolidation.

The proliferation of Dental Service Organizations is arguably the single most significant external driver of consolidation in the lab industry. DSOs, which provide non-clinical business management support to dental practices, now employ a substantial and rapidly growing share of all U.S. dentists, with some estimates suggesting they employed at least 13% of dentists as of 2024 and could represent 75% to 80% of the entire dental industry within the next decade.3

The DSO model fundamentally alters the traditional lab-dentist relationship. By centralizing administrative functions, DSOs also centralize procurement. They leverage their collective purchasing power to negotiate highly favorable, lower prices from all suppliers, including dental labs.5 This dynamic creates a market environment that heavily favors large DLOs like Glidewell and NDX. These national lab networks have the scale, standardized production processes, and logistical capabilities to meet the volume and aggressive pricing demands of large DSO contracts.26 Smaller, independent labs are often unable to compete for this large and expanding segment of the market, effectively cutting them off from a major source of business.

The dental industry has become a prime target for private equity (PE) investment. Investors are attracted to the sector's historical fragmentation, stable demand, and the clear opportunity to generate returns through consolidation, or "roll-up," strategies.3 This influx of PE capital has a dual effect. First, it fuels the rapid expansion of DSOs, which in turn increases the market pressure on small labs. Second, it directly targets the laboratory sector itself.

PE firms and their portfolio companies are actively acquiring dental labs to build larger, more efficient DLOs. This has intensified merger and acquisition (M&A) activity and driven up the valuation multiples, typically based on a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), for attractive laboratory targets.28 The availability of a lucrative exit strategy makes selling to a larger group an appealing option for many independent lab owners, particularly those nearing retirement, thus further accelerating the pace of consolidation.11

Beyond the pressures from DSOs and PE, independent labs face a series of internal economic and demographic challenges that make survival increasingly difficult.

The most critical operational challenge confronting the U.S. dental laboratory industry is a severe and structural shortage of skilled labor. This workforce crisis not only constrains the growth potential of individual labs but also acts as a primary catalyst forcing the industry-wide adoption of new technologies and business models.

According to the BLS, there were an estimated 34,190 dental laboratory technicians employed in the U.S. as of May 2023.20 This figure has remained remarkably flat over the past several years, with the BLS reporting similar numbers in prior surveys: 35,100 in 2023 (a broader category), 34,150 in 2021, and 34,460 in 2019.31

The stability of the technician workforce, when viewed alongside the sharp decline in the number of laboratory establishments, provides a clear picture of labor consolidation. Technicians are not leaving the profession in droves; rather, they are migrating from shuttered small and mid-sized labs to jobs within the larger, growing DLOs. However, the static nature of the total workforce in a growing market points to a deeper problem: the industry's inability to attract new talent to meet rising demand.

This inability to expand the labor pool is the central engine of the industry's transformation. Labs are faced with an existential challenge: how to increase production to satisfy a market growing at over 6% annually with a workforce that is stagnant at best and aging rapidly.1 The only viable path forward is to dramatically increase the productivity of each remaining technician. This reality makes investment in labor-saving digital technology—such as CAD/CAM systems, automation software, and AI—not a strategic choice for competitive advantage, but an absolute necessity for survival. This technology, in turn, demands new competencies, transforming the role of the technician from a manual artisan focused on waxing and casting to a digital workflow manager proficient in software, scanning, and milling operations.10 Therefore, the workforce crisis is the direct cause of the mandatory technological shift that, due to its high cost, is the primary mechanism driving industry consolidation.

The root of the technician shortage lies in the near-complete collapse of the formal education system for dental laboratory technology (DLT). The number of DLT programs accredited by the Commission on Dental Accreditation (CODA) has plummeted. A 62% decline has been observed since 1992, with the number of programs falling from 22 in the 2005-06 academic year to just 13 by 2022-23.6

The decline in enrollment within these few remaining programs is even more alarming. First-year enrollment dropped from 418 students in 2005-06 to a mere 223 in 2022-23, a decrease of nearly 47%.6 In 2012, it was noted that all accredited programs combined could only produce a graduating class of around 300 students annually.8 This output is grossly insufficient to replace the thousands of technicians retiring from the field each year. This broken pipeline forces most labs to rely on on-the-job training for new hires, a far less efficient and comprehensive method that can compromise the quality and consistency of work and places a significant burden on senior staff.27

Compounding the issue of a shrinking talent pool are the economic realities of the profession. The mean annual wage for a dental technician was $52,390 as of May 2023, with the median wage at $47,690.20 While this represents an increase from previous years, it remains a modest salary for a skilled trade that requires significant dexterity, technical knowledge, and attention to detail. This wage level makes the profession less attractive to young people choosing a career path, especially when compared to other technical or healthcare-adjacent fields.11

Consequently, recruitment and retention have become paramount challenges for lab owners. The intense competition for a limited number of qualified technicians drives up labor costs, further squeezing already tight margins and hindering the ability of labs to scale their operations to meet demand.26

Technology is the central force shaping the modern dental laboratory. It offers the solution to the industry's most pressing challenges, particularly the labor shortage, but its high cost also serves as a primary driver of the consolidation that is eliminating smaller players.

Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) technology has moved from a niche innovation to an indispensable core component of any competitive dental laboratory. First introduced to dentistry in the 1980s, these systems have fundamentally revolutionized the fabrication of restorations.9 The CAD/CAM workflow allows for the creation of crowns, bridges, veneers, and other prosthetics with a level of precision, speed, and consistency that is unattainable through traditional manual methods.35

The process streamlines the entire production chain. It begins with a digital impression captured by an intraoral scanner at the dental office, which eliminates the need for uncomfortable and error-prone physical impression materials.9 This digital file is then sent to the lab, where a technician uses CAD software to design the restoration. The final design is sent to a CAM milling machine, which carves the restoration from a block of high-strength ceramic or other advanced material.38 This digital workflow dramatically reduces turnaround times, enabling single-visit restorations in some in-office settings and allowing labs to operate with far greater efficiency.37

However, this technological advantage comes at a steep price. The high initial capital investment required for scanners, design software licenses, and milling machines represents a significant financial barrier. As noted previously, the cost to open a competitive lab has increased tenfold, from under $20,000 to over $200,000, largely due to these technology costs.8 This financial hurdle makes it exceptionally difficult for small labs to enter the market or keep pace with the necessary upgrades, directly contributing to the consolidation trend as they are either acquired or forced to close.11

Building on the foundation of CAD/CAM, the next wave of technological disruption is being driven by 3D printing (additive manufacturing) and the development of new materials. Unlike milling, which is a subtractive process that carves a shape from a solid block, 3D printing builds restorations layer by layer. This method is highly efficient, significantly reduces material waste, and allows for the creation of more complex geometric structures.10 It also expands the palette of usable materials to include a wide range of biocompatible resins, plastics, and metals.

The evolution of digital manufacturing techniques is inextricably linked to the development of advanced restorative materials. The market is shifting away from traditional metal-ceramics toward high-strength, aesthetically superior materials like monolithic zirconia and other all-ceramic options. The fabrication of these materials is only possible through the precision of digital milling and printing, creating a symbiotic relationship where new materials drive demand for new technology, and new technology enables the use of new materials.1

Artificial intelligence represents the newest technological frontier for dental laboratories, offering the potential to further automate workflows and, most critically, to amplify the productivity of the scarce technician workforce. Current and emerging AI applications include:

The integration of these advanced technologies is fundamentally reshaping the relationship between the dental laboratory and the dental practice. The traditional workflow was linear and transactional: a dentist would take a physical impression, send the case to the lab with a prescription, and the lab would fabricate and return the physical product.9 The digital workflow, by contrast, is interactive and collaborative. Cloud-based platforms and integrated software allow the dentist and the lab technician to share digital files and communicate in real-time.36

Furthermore, the pace of innovation in materials and technology is now so rapid that many dentists rely on the laboratory's expertise to navigate the options.7 The lab's role is evolving from that of a simple fabricator to that of a consultative partner. A modern, digitally-enabled lab can advise the clinician on the optimal material choice for a specific clinical situation, collaborate on the digital design of the restoration in real-time, and serve as a technical expert for troubleshooting complex digital cases.34 This shift transforms the lab's value proposition. Success is no longer measured solely by the ability to produce a quality restoration at a competitive price; it is increasingly defined by the ability to provide essential technological expertise, seamless workflow integration, and a true collaborative partnership. Labs that successfully embrace this new role can build deep, defensible client relationships that are insulated from purely price-based competition.

The confluence of consolidation, workforce shortages, and technological disruption is forging a new reality for the U.S. dental laboratory industry. Navigating this future successfully will require a clear understanding of the emerging market structure and a decisive commitment to a well-defined strategic path.

The future landscape of the dental laboratory industry will be dominated by two successful, yet distinct, business models. The "hollow middle" of undifferentiated, mid-sized labs will continue to shrink, making a strategic choice between these two paths essential for survival and growth.

For a mid-sized lab, the status quo is no longer a viable long-term strategy. The owner must conduct a critical assessment and make a deliberate choice: either seek investment and merger partners to pursue a strategy of scale or downsize and refocus the business to become a dominant player in a profitable, high-value niche.

Regardless of whether a lab pursues a strategy of scale or niche, a set of core competencies will be non-negotiable for future success. The profile of a "future-proof" laboratory includes the following characteristics:

The evolving landscape presents both significant opportunities and formidable challenges for industry participants.